HTS Code and U.S. Tariff Lookup

Enter your product description to receive a comprehensive tariff analysis across key manufacturing countries including China, Vietnam, Bangladesh, India, and more. Our AI-powered system will determine the appropriate HTS code and let you verify with official database.

Note: This advanced tool is exclusively available to our "Team" and "Corporate" Subscribers. Learn about our subscription options

Key Features:

- Multi-Country Analysis: Compare tariffs across 10 major manufacturing countries

- Official HTS Link: Direct link to USITC database for verification

- Latest Updates: Incorporates latest announced tariff changes

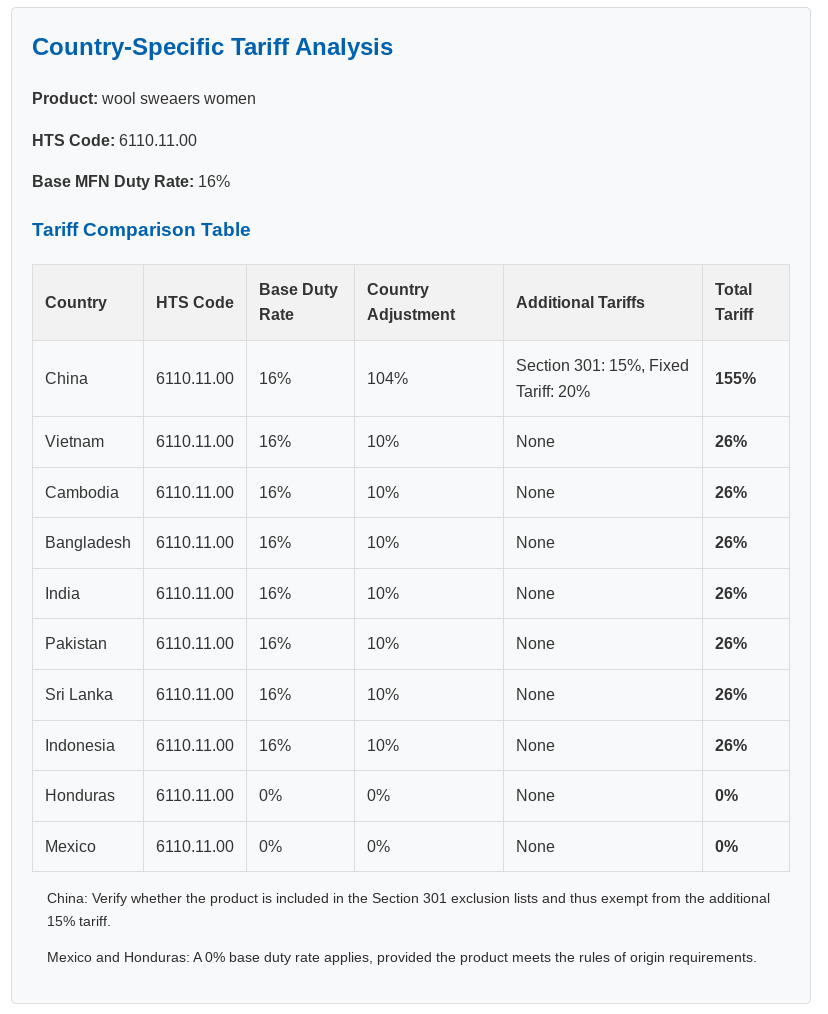

Example Results:

🔍

Click to enlarge

Sample tariff comparison table for men's cotton shirts (HTS 6110.20.2075)

How It Works:

- Enter a detailed product description (e.g., "men's cotton woven shirts")

- Receive a proposed HTS code and a direct link to the USITC database

- Check the MFN (Most-Favored Nation) duty rate and submit the entry

- Review your comprehensive tariff analysis, including duty breakdowns and source references

Benefits:

Save Time

Get accurate HTS classifications in seconds instead of hours of manual research

Reduce Costs

Compare sourcing options to minimize tariff expenses

Ensure Compliance

Verify classifications with direct links to official sources

Strategic Planning

Make informed decisions about your supply chain